Married, but uncomfortable bedfellows.

The spring round of conferences is drawing to a close and it’s clear our industry is in robust health. Attendances were good, conversations were unfettered and it’s great to see how technology for tax keeps moving forward.

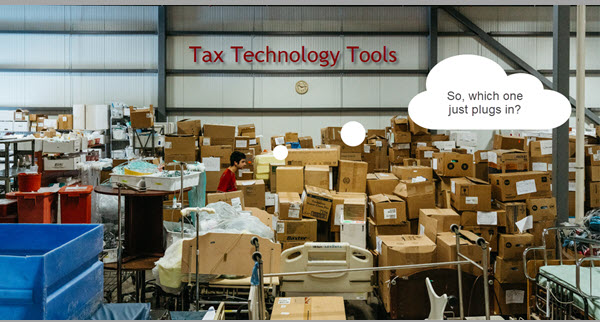

However, something else stands out. The gap between the capability offered by tax technology and the degree to which those capabilities are capitalized upon effectively by customers is wide, and if anything, growing wider.

There’s no doubt that corporate tax people now accept the role of technology as integral to the function, but they’ve not yet worked out how to get the best from it. They somehow still expect it to work like a smartphone app. It doesn’t. They keep trying different options until it does. It won’t.

How can it? A smartphone app deals only with a single, tiny, personal aspect of a person’s life while tax technology must reach ever further across the complexity and vastness of corporate organizations. Nor does it work like Henry Ford’s assembly line for the Model T or the robotic arms that assemble microchips.

But why not? The answer is data, or to be exact, enterprise data. That enigmatic, frustrating, monstrously potent, ephemeral, technicolor dream-coat that is data, and the root behind the phrase, ‘knowledge is power’ (and after all, tax people are knowledge-workers). Unleashed data can exercise operational control across the globe while you sleep and give you superhuman powers, provided you think and harness it correctly. Few do.

In fact, the degree or lack of knowledge about our industry-specific digital world is shocking, so providing better tools is like offering better golf clubs to someone who doesn’t play golf in the first place. And if vendors then try and create clubs for non-players, the end result is no longer golf.

There’s only one thing for it – tax people will have to learn a few, high-level basics, but like long-time singletons adjusting to being newly married, this takes a little doing. We suggest the answer is taxology in an easily digestible form, along with help from ‘taxologist as a service‘.

Until robots learn to play golf by themselves or understand a digital tax solution in all its guises, there’s no other way to avoid the oppression of unruly systems and data, and step out into the digital sunlight.

Someday in the future, people will look back on this day and wonder how we got by. It’s past time to accept that this enduring work-in-progress relationship between tax and technology is unacceptable and do something about it. Come and join those that already have.

No comment yet, add your voice below!