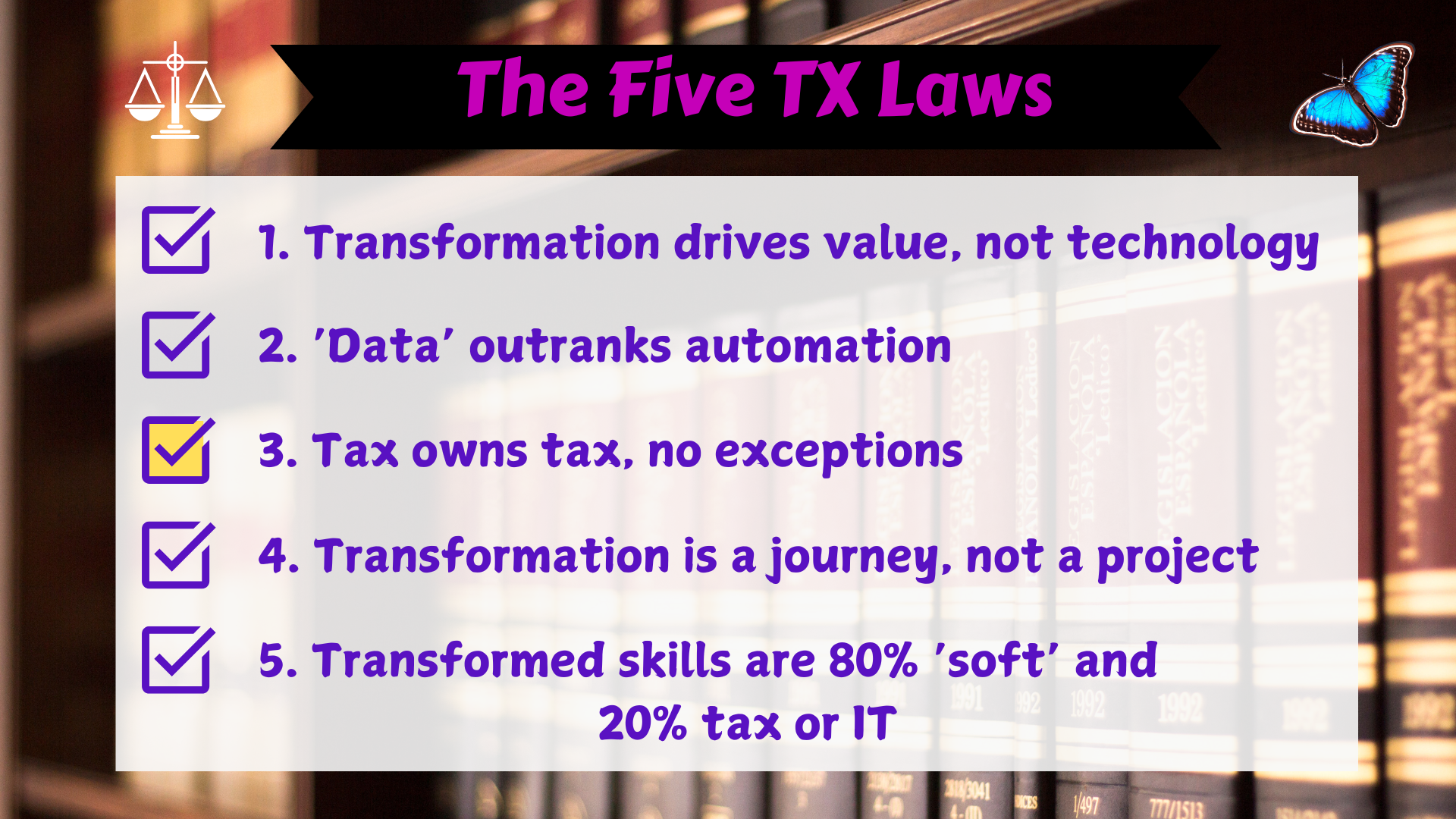

The Five TX Laws are a form of universal truth. We know this because astute individuals consistently arrive at the same or similar set of conclusions after pursuing the tech-centric route for some time.

This is the third of five articles where we explore each law, starting with a guiding principle and then a conversational narrative that provides real-world context in everyday language. For this, we imagined chatting with an intelligent friend, sipping brandy in comfortable armchairs by a fire (mental imagery inspired by The Economist Style Guide).

TX Law #3: Tax owns Tax, no exceptions

Principle: Technology enables tax persons to be responsible for tax and tax data at source company-wide.

Fireside chat:

Intelligent friend: “Our global VP of Tax was on a conf call last week. He was quite blunt about it—he said, ‘Tax does not own upstream data. That’s not our responsibility.'”

Taxologist: “Interesting. What was the purpose of the call?”

Intelligent friend: “We’re modernizing our legacy ERP. It’s greenfield, so we’re sweeping away old systems, switching vendors, moving to the cloud, and re-evaluating processes. Everyone’s trying to figure out what it means for them.”

Taxologist: “What about e-invoicing? Does your VP see that it pushes tax’s pinch points upstream?”

Intelligent friend: “Not really. So far, our approach to e-invoicing has been minimalist and handled by finance.”

Taxologist: “OK, well—if you don’t mind me saying—that view is already a thing of the past. While traditional tax departments are pushed back to specialist compliance and loss prevention only, the rest of the company is moving forward. The future is digital. He should accept that and take responsibility. I’m sure he’s aware—I imagine he’s just apprehensive.”

Intelligent friend: “Should he be apprehensive?”

Taxologist: “Ha, ha! Well, yes, but it won’t help. He can either adapt or fall behind. What’s the situation regarding a tax engine at your company?”

Intelligent friend: “We don’t have one—well, not a proper one. He’s advocating we work with a vendor to get one.”

Taxologist: “That’s good, but he’s missing a trick. Like many people, he probably thinks the purpose of a tax engine is to calculate tax. It’s not—the main purpose of a tax engine is to give tax people control over tax at source. The project is the same. The main purpose of the project is not to install a tax engine—it’s to build a tax determination capability in the tax function that values people and data over tech, and gives long-term control over the tax solution to Tax. The point is the tax engine is his opportunity to ‘get tax data right first time at source.'”

Intelligent friend: “Wait a minute—so, you’re saying the tax engine means he takes responsibility for tax data in the source systems!?”

Taxologist: “Sure. That’s the goal. Of course, responsibility is shared with upstream, and the tax function must be overhauled to handle it—but if he does not take this opportunity, he’s running substantial risks as tax authorities ramp up their digital capabilities. They’re building sophisticated digital profiles on taxpayers, and he must respond to protect his company’s license to operate.”

Intelligent friend: “I see. So, digitalization and data are the keys, but that’s a major change for him, right!?”

Taxologist: “Absolutely! In fact, it’s transformative in the true sense of the word—not just more tech. In reality, tech is the facilitator that extends tax’s reach and enables them to drill down and play a greater role across the organization. Historically, tax managers outsourced it to IT or finance, or left it to chance, because they deemed it not a core competency. That’s now a risk. Tax is too complex, changing too fast, and under too much scrutiny to leave it to others. If tax can’t keep up, how can non-specialists be expected to do it for them? The tools exist. Tax must transform to use those tools to own the space that’s naturally theirs.”

Check out previous articles at TX Law #1 and TX Law #2.

Remember to join us at WU Tax Law Technology Center course in Vienna – Nov 2024, where we will explore business use cases, discuss specific strategies, and workshop practical aspects of tax transformation.

Until next time …

No comment yet, add your voice below!